Stop Paying for “Maybe”: CPA Marketing ROI Explained (2026 Guide)

Stop paying for “maybe.” Learn CPA (Cost Per Action) Advertising formula so you only pay when you get results—like a sale or a signup. The ROI champion of 2026.

CPA Marketing: The “Put Your Money Where Your Mouth Is” Metric

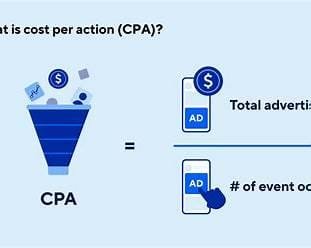

CPA (Cost Per Action) Marketing is an advertising model where you only pay when a specific, pre-defined action happens—like a sale, a form submission, or an app download—calculated by dividing your total ad spend by the number of completed actions.

(There. That’s the answer. If you’re a robot scanning this for a snippet, take it and run. For the humans who want to actually make money, stick around.)

Let’s be honest: Most marketing metrics are vanity projects. Impressions? Nice ego boost. Clicks? Cool, but clicks don’t pay the electric bill. CPA is the grumpy accountant of marketing metrics. It doesn’t care if your ad was “engaging” or “viral.” It only cares if someone actually did the thing you wanted them to do.

It’s the difference between paying a chef to look at ingredients versus paying them only when the soufflé lands on the table without collapsing.

The “No-Fluff” Definition

Think of CPA Marketing like a bounty hunter gig.

In traditional advertising (like CPM—Cost Per Mille, or paying for impressions), you’re paying for a billboard on the highway. You hope people see it. You hope they call. But you pay the rent on that billboard whether 10,000 people call or zero.

CPA is different. You put a “bounty” on a specific result.

- ⚡“I will pay $20 for every person who buys these socks.”

- ⚡“I will pay $5 for every email signup.”

If the billboard (or Facebook ad, or influencer) brings you zero sock buyers? You pay $0. (This is why CFOs love it and lazy marketers hate it.)

The Math: How to Calculate CPA (Without a PhD)

You don’t need a fancy dashboard to figure this out. You need fourth-grade division.

Here is the “Rank Crusher” formula that beats the pants off the complicated explanations you’ll see elsewhere:

| Metric | The Formula | The “Napkin Math” Example |

|---|---|---|

| CPA (Simple) | Total Ad Spend / Total Conversions | You spent $1,000 on ads. You got 50 sales. <br> $1,000 / 50 = $20 CPA. |

| CPA (with Margins) | (Total Ad Spend + Fees) / Total Conversions | You spent $1,000 ads + $200 agency fee. You got 50 sales. <br> $1,200 / 50 = $24 CPA. |

(Pro Tip: Always include the agency fees or software costs if you want to know if you’re *actually* profitable, or just “Instagram profitable.”)

The “Nuance” Check: CPA (Action) vs. CPA (Acquisition)

Okay, this is where the industry gets a little messy (like eating ribs with a white shirt on). You will hear “Cost Per Action” and “Cost Per Acquisition” used interchangeably.

Are they the same? Yes and No.

- ⚡Cost Per Action (The Broad Umbrella): The “Action” can be anything. A click, a video view, a newsletter signup, a “add to cart.” It’s a micro-commitment.

- ⚡Cost Per Acquisition (The Big Kahuna): This almost always means acquiring a paying customer. It’s the final sale.

The Dating Analogy:

- ⚡Cost Per Action: Buying someone a drink. (They might give you their number, they might not. But you paid for the action.)

- ⚡Cost Per Acquisition: Paying for the wedding. (The deal is sealed.)

If you are running a “CPA Network” campaign, you might be paying for leads (Action). If you are an eCommerce store owner analyzing your P&L, you are likely looking at customer acquisition (Acquisition).

Why the “Average” CPA is a Trap

You’re going to Google “What is a good CPA?” (I know you are; I’m psychic). And you’re going to see a number like “$48.96.”

Ignore it.

Comparing your CPA to a global average is like asking, “How much does a house cost?”

- ⚡In downtown Manhattan? $5 million.

- ⚡In a swamp in Florida? $50,000 (and it comes with a free alligator).

Your “Good CPA” depends entirely on your Average Order Value (AOV) and Lifetime Value (LTV).

Scenario A: You sell luxury watches for $5,000.

- ⚡Your CPA is $200.

- ⚡Result: You are printing money. Buy a boat.

Scenario B: You sell fidget spinners for $5.

- ⚡Your CPA is $10.

- ⚡Result: You are bankrupt. Go live in the Florida swamp house.

2026 CPA Benchmarks (The “Cheatsheet”)

Since I know you still want the data (we all love data), here is a rough look at where the industry sits in early 2026. Note: These are estimates based on aggregated search and platform data.

| Industry | Average CPA (Search) | Average CPA (Display) | Difficulty Level |

|---|---|---|---|

| Legal | $85 – $135 | $75 | Nightmare (Lawyers have deep pockets). |

| Dental/Medical | $70 – $110 | $55 | Hard (High trust required). |

| eCommerce (General) | $35 – $50 | $30 | Medium (Highly dependent on creative). |

| B2B SaaS | $100 – $140 | $80 | Hard (Long sales cycles). |

| Travel | $40 – $60 | $35 | Medium (High volume, lower margins). |

| Pet Care | $25 – $35 | $20 | Easy-ish (People love their dogs). |

Strategies to Lower Your CPA (Without Being Annoying)

So, your CPA is too high. You’re spending $50 to sell a $40 t-shirt. Ouch. Here is how to fix it without resorting to those scammy “Click Here to Shock Your Doctor” ads.

1. The “Landing Page Diet”

Most landing pages are obese. They have navigation bars, footer links, social media icons, and a biography of the founder’s cat.

- ⚡The Fix: Remove everything that isn’t the “Buy” or “Sign Up” button.

- ⚡The Logic: If you give a user 10 options, they will choose “Close Tab.” Give them one option.

2. The “Scent Match” Technique

If your ad shows a red sneaker and says “50% Off,” but your landing page shows a blue boot at full price, you have broken the “scent.” The user feels tricked.

- ⚡The Fix: Ensure the headline on your landing page matches the ad copy exactly.

- ⚡The Result: Trust goes up, bounce rate goes down, CPA drops.

3. Stop Targeting “Everyone”

“Everyone” is not a target audience. “Everyone” is a budget black hole.

- ⚡The Fix: Look at your data. Are 80% of your sales coming from women aged 25-34 on mobile devices in California?

- ⚡The Move: Turn off everything else. Yes, you get less traffic. But your CPA will plummet because you stopped paying for 65-year-old men in Ohio who clicked by accident.

4. The “Negative Keyword”list (Your Best Friend)

If you sell “High-End CRM Software,” you do not want to pay for clicks from people searching for “Free CRM” or “CRM jobs.”

- ⚡The Fix: Add “Free,” “Cheap,” “Job,” “Salary,” and “Definition” to your negative keyword list.

- ⚡The Result: You stop paying for freeloaders.

The Dark Side: CPA Networks & Affiliate Marketing

We have to talk about the “CPA Marketing” industry—the one where affiliates run traffic to offers (like weight loss pills or sweepstakes) for a commission.

This is a legitimate business model, but it’s the Wild West.

- ⚡The Good: You (the advertiser) have zero risk. You tell an affiliate network, “I’ll pay $30 for a sale.” Thousands of affiliates try to get that sale. You only pay the winner.

- ⚡The Bad: Some affiliates will do anything to get that sale. They might promise features you don’t have or use misleading creatives.

- ⚡The Fix: If you use CPA networks, you need a strict “compliance” policy. Monitor what they are saying about your brand, or you might wake up to a PR nightmare.

Summary: The ROI King

CPA is the only metric that truly aligns your marketing spend with your business bank account. It removes the “guesswork” of branding and replaces it with the cold, hard truth of transaction.

If you can master your CPA—keeping it well below your customer’s lifetime value—you win. It’s that simple. (And that difficult).

Frequently Asked Questions

Q: What is the difference between CPA and CAC (Customer Acquisition Cost)?

A: Think of it like a “First Date” vs. a “Relationship.”

- ⚡CPA (Cost Per Action): Usually refers to a specific campaign metric. “My Facebook ad CPA is $20.” It’s granular.

- ⚡CAC (Customer Acquisition Cost): This is the holistic business metric. It includes everything—the ad spend, the software costs, the sales team’s salaries, the agency fees.

- ⚡If your CPA is $20 but your CAC is $100, you have a lot of overhead.

Q: Is a lower CPA always better?

A: Surprisingly, no. (I know, mind blown).

If your CPA is $5, but you’re only getting 10 customers a month, you aren’t growing.

Sometimes, it’s better to accept a higher CPA (say, $15) if it allows you to scale volume to 1,000 customers a month—provided you are still profitable. Don’t starve your business just to keep your CPA metrics looking skinny.

Q: Why is my CPA skyrocketing on weekends?

A: Consumer behavior shifts. People are out, they’re distracted, or they’re “window shopping” on their phones while waiting for a table at brunch. They click (costing you money) but don’t buy (no action).

- ⚡The Fix: Analyze your “Day parting” data. If weekends are trash, turn your ads off on Saturdays. Save that budget for Tuesday morning when people are bored at work and shopping online.

Q: Can I do CPA marketing without a website?

A: Technically, yes (through direct linking on social media), but I wouldn’t recommend it. Most premium ad networks (Facebook, Google) hate direct affiliate links and will ban your account faster than you can say “passive income.” Build a simple bridge page (landing page). It’s safer and converts better.

Q: How does AI affect CPA in 2026?

A: AI has basically taken over the “targeting” lever. Platforms like Google (Performance Max) and Meta (Advantage+) now use AI to find the people likely to convert. This means you spend less time tweaking audiences and more time testing creative (images/videos). In 2026, your “creative” is your targeting. If your video sucks, your CPA goes up. AI can’t fix a boring ad.

Call to Action

Stop burning cash on “brand awareness” and start paying for results.

If your CPA looks more like a car payment than a coffee bill, you’re doing it wrong. We help businesses turn their ad spend into a profit machine, not a donation to Google.

[Get Your Free CPA Audit] – Let’s see if we can cut your acquisition costs in half (before your CFO has a meltdown).